Sticpay Extends Money Transfer Service to Over 100 Countries

Weekly APAC news up to Wednesday, 15th of January 2025.

👀 NEWS HIGHLIGHT

This collaboration aims to deliver revolutionary digital payment channels, allowing both institutions to expand their reach and impact, while also supporting Qatar’s national vision for digital innovation.

📰 ARTICLE OF THE WEEK

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🧋 REGIONAL HIGHLIGHTS

⭐️ Accenture Acquires Digital Twin Technology for Banks to Enhance Core Modernization Capabilities.

⭐️ Checkout.com and Noqodi collaborate to revolutionize payment services in the UAE

⭐️ NomuPay raises $37M at a $200M valuation to build payment rails in underserved markets across Asia.

⭐️ Sticpay extends money transfer service to over 100 countries.

Navigate Europe’s evolving FinTech landscape. Get the latest insights delivered weekly—subscribe today.

AUSTRALIA 🇦🇺

Banking Circle set to purchase Australian Settlements Limited. This acquisition marks a key step in the bank’s goal of building a global hub for real-time clearing and settlement for all major currencies and accelerating its expansion. The strategy specialises in providing financial infrastructure to banks and payment businesses.

SINGAPORE 🇸🇬

Singapore will not include credit card fraud in Shared Responsibility Framework, citing existing robust protections for consumers. This clarification came in response to a parliamentary question on the prevalence of credit card fraud in the country. Continue reading

XTransfer gets green light for Singapore Payment License. The license, issued on 1 January 2025, allows XTransfer to offer services such as account issuance, domestic and cross-border money transfers, flexible top-up options, and e-money issuance in Singapore. Continue reading

Nium launches Diners Club International Card. The introduction provides Nium travel customers with even greater payment flexibility, acceptance and choice, reinforcing Nium’s position as a scheme-agnostic innovator in the travel payments industry.

Bitget launches bank deposits with ZEN. With this integration, Bitget users can now seamlessly deposit and withdraw funds using 11 supported fiat currencies. This collaboration shows Bitget's focus on enhancing accessibility and improving the user experience, particularly in underserved European markets and major regions such as Oceania.

Reap gets in-principle approval for Singapore payment license. The approval is a step forward for Reap Singapore, the company’s local entity, as it works toward meeting the conditions required to obtain the full license. Reap intends to allocate necessary resources to support its Singapore operations and strengthen compliance standards.

SEA FinTech raises $1.6b, funding drops 23% in 2024. Southeast Asia’s FinTech sector raised US$1.6 billion in 2024. This figure represents a 23% decline from US$2.1 billion in 2023 and a 75% drop from US$6.3 billion in 2022, according to data from Tracxn.

CHINA 🇨🇳

WeLab Bank hit first breakeven in December 2024. The bank recorded a 26% year-on-year increase in net interest income, totaling nearly HK$700 million (around US$89.8 million), and a 50% improvement in net interest margin after the online lending platform WeLend became its wholly owned subsidiary last year.

THAILAND 🇹🇭

Thailand tests crypto payments with Phuket for tourists. The initiative, announced by Deputy Prime Minister and Finance Minister, aims to allow foreign visitors to make payments using Bitcoin and other digital currencies, offering a seamless alternative to cash transactions. Continue reading

UNITED ARAB EMIRATES 🇦🇪

Visa partners with Qashio. The partnership aims to address the needs of the travel and tourism industry in the UAE and beyond by introducing the Visa Commercial Choice Travel programme. The initiative will simplify corporate travel payments, with global issuance capabilities covering the UAE, Mena, Europe, and the UK.

Arf and LuLu Financial Holdings announce strategic partnership to revolutionize settlement times in global and cross-border payments. This collaboration will allow LuLuFin to leverage Arf's advanced settlement infrastructure, offering T-0 settlement times.

StanChart forms new entity for digital assets custody services. Standard Chartered, has formed a new entity in Luxembourg to offer crypto and digital asset custody services in the European Union, as the global lender looks to cash in on the growing demand for digital security.

INDIA 🇮🇳

Briskpe launches cross-border payments. By combining A2A transfers with card- and wallet-based collections, BRISKPE offers MSMEs unparalleled flexibility to cater to diverse client preferences, broaden market reach, and accelerate growth. With this integration, businesses can tap into a global network of users and unlock new opportunities.

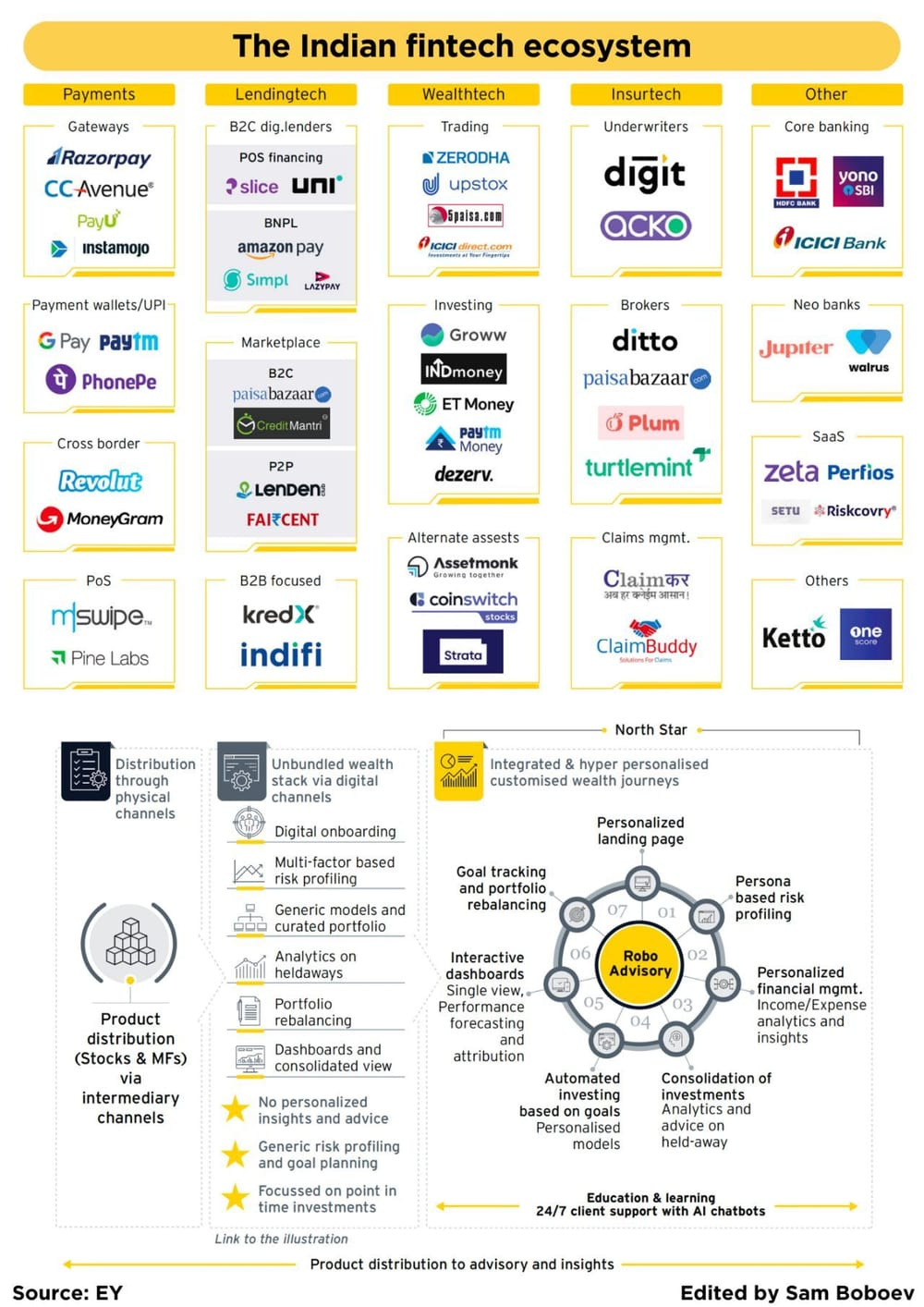

Groww, India’s biggest trading app, prepares to file for an IPO in the next 10 to 12 months, seeking a valuation between $6 to $8 billion. The startup enables customers to invest in mutual funds and make UPI transactions, shifted its domicile to India from the U.S. last year as part of IPO preparations.

KUWAIT 🇰🇼

Objectway enters MENA with Markaz partnership. This collaboration marks a significant milestone in Objectway's growth in the region. Objectway will support Markaz in delivering an enhanced client experience for their clients, by significantly improving and automating processes and seamless client journeys.

INDONESIA 🇮🇩

Grab-backed Superbank adds OVO to ecosystem. Superbank, the Indonesian digital bank, is set to expand its ecosystem by integrating with OVO. Through this collaboration, Superbank aims to broaden its financial service offerings. Read More

PHILIPPINES 🇵🇭

Top Philippine FinTech taps banks for IPO. GCash has picked banks to work on an initial public offering that could take place this year. It has selected JPMorgan Chase & Co., Morgan Stanley and UBS Group AG to work on the potential share sale, the people said, asking not to be identified because the matter is private.

PAKISTAN 🇵🇰

Abhi partners with UAE’s Al Ansari Financial Services. The alliance will provide EWA and SNPL services to complement Al Ansari Financial Services’ existing portfolio from the second quarter of this year, Abhi said. This will help address the varied needs of both unbanked and underbanked communities in the UAE, it added.