Razorpay Invests $30M in Consumer Payments Startup Pop

Weekly APAC news up to Wednesday, 18th of June 2025.

👀 NEWS HIGHLIGHT

Pop, a consumer payment platform, has raised $30 million from payments solutions company Razorpay. This investment will go towards solving two of India’s most pressing challenges in digital commerce: rising customer acquisition costs (CAC) for merchants and the lack of meaningful rewards for consumers, the company said.

The company operates a rewards-first UPI payments app that merges payments, commerce, and credit into one experience. It has previously raised funding from several marquee investors, including India Quotient, Unilever Ventures, Incubate Fund, and Nuventures.

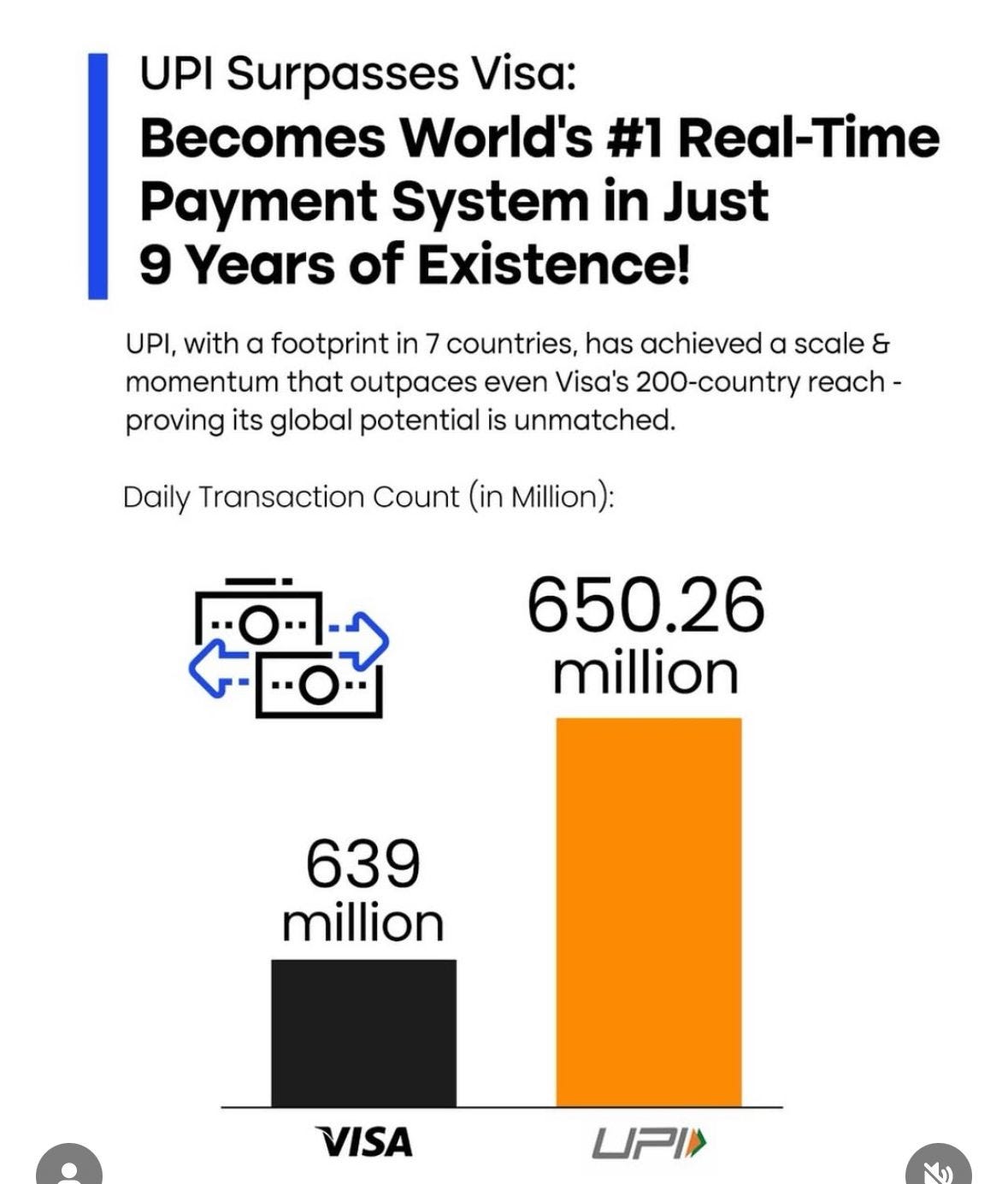

📊 INFOGRAPHIC

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🧋 REGIONAL HIGHLIGHTS

⭐️ Mastercard onboards customers up to four times faster with Cloud Edge.

⭐️ Digital assets are legalized in Vietnam.

⭐️ Kbank surpasses 14 million customers amid rapid growth.

⭐️ Capitron Bank joins Thunes’ global network to enhance payment efficiency in Mongolia.

AUSTRALIA 🇦🇺

Nexxtap teams up with Samsung to launch Tap to Phone payments. Through this move, Nexxtap and Samsung seek to improve the payment experience with simplified, embedded tap-to-pay functionality, with the two companies planning to eliminate the need for legacy terminals.

Mortgage Choice taps NextGen to bring open banking to brokers. Mortgage Choice is set to make open banking part of its loan application process through a new partnership with technology provider NextGen, allowing its network of brokers to access real-time financial data using the Frollo Financial Passport.

SINGAPORE 🇸🇬

Vistra acquires payroll platform iiPay. The acquisition is expected to serve Vistra's clients with "improved automation in payroll processing, enhanced multi-country payroll consolidation and reporting, and stronger support for complex international operations", according to a statement.

Trident Digital to create XRP treasury of up to $500M. The reserve will be funded through stock issuance and other financial instruments. Through this initiative, Trident aims to demonstrate how public companies can thoughtfully and responsibly participate in the ongoing development of decentralized finance.

Interlace launches white-label card solutions to power personalized enterprise payments. A white-label card allows enterprises to customize their design, such as adding a brand logo or tailoring the card appearance, giving their bank cards a distinct and branded look.

MALAYSIA 🇲🇾

Ria Money Transfer sets sights on supporting businesses in Malaysia to manage worker wages. The Ria Wallet enables users to deposit funds, withdraw cash from ATMs, pay bills, and also facilitates domestic and international transfers. Customers can also make payments in millions of locations via QR payment linked to DuitNow.

THAILAND 🇹🇭

KuCoin launches SEC-Licensed crypto exchange in Thailand. The platform is licensed by Thailand’s Securities and Exchange Commission and is now available to all eligible users after an initial invite-only phase. Keep reading

INDIA 🇮🇳

Sebi set to launch new UPI mechanism for MFs and brokers. This initiative aims to ensure investors make payments only to verified entities, accompanied by a visual verification cue. A 'Sebi check' functionality is also under development, allowing investors to verify the authenticity of their UPI ID.

Travel FinTech Scapia launches Rupay credit card to target UPI payments, merges credit line and statement with Visa card. Users can see a unified credit card statement, and a single bill is generated at the end of the billing cycle. The company targets young millennials and Gen Z customers who are looking for travel offers and rewards.

Snapmint set to raise $40M led by General Atlantic. This will be the third funding round for the Mumbai-based startup since March 2022. The company attributes much of its growth to D2C brands using Snapmint’s installment payment options.

FinTech startup Zype secures debt. The proceeds of this debt funding will be used to augment the long-term working capital needs of the company, the filing added. The FinTech platform last raised funds in December 2022, securing Rs 146 crore (approximately $17.7 million) from its existing investor, Xponentia Capital.

Groww triples FY25 profit to Rs 1,819 crore; closes fresh funding at $7 billion valuation. Bengaluru-based FinTech closes $200 million funding round led by Singapore’s GIC ahead of IPO. The fundraiser also drew participation from existing investors, including Iconiq Capital.

Sequoia, Greylock, and Nik Storonsky’s QuantumLight invest $90M into FinTech for overseas diasporas. There are plans to launch an interest-incurring multi-currency account, which will take advantage of an Indian government subsidy on foreign currency accounts held in the country, and to launch a full-stack Indian bank account for NRIs.

PAKISTAN 🇵🇰

Allied Bank, UnionPay, and Paysys partner to launch tokenized tap-and-pay in Pakistan. This collaboration empowers ABL customers. ABL will now offer tokenized mobile payment solutions that replace sensitive cardholder data with unique tokens, enhancing security while enabling faster transactions.

MOVERS & SHAKERS

PayG appoints Harmeet Sethi as Chief Executive Officer. Sethi's leadership is expected to drive the company's growth and expansion in the FinTech sector. Under his guidance, PayG aims to enhance its mobile app offerings, focusing on convenience, accessibility, and security for users and merchants alike.

FamApp co-founder Kush Taneja to step down, in talks to sell stake. Taneja’s exit comes amid an overhaul at FamApp, which has restructured operations, shifted away from its teen-focused model, and grappled with funding challenges. Read more