Butn and APX Lending Partner to Service the APAC Crypto-Backed lending Market

Weekly APAC news up to Wednesday, 11th of December 2024.

REPORT

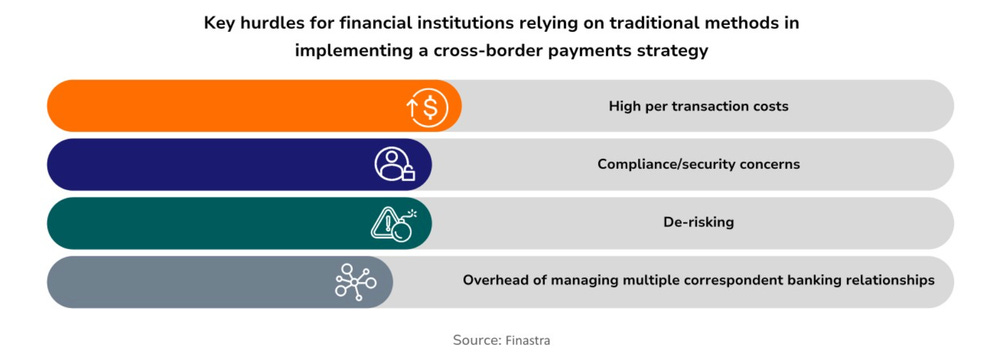

Take a look at “Unlocking instant cross border payments in APAC” report. Global cross-border ecommerce is expected to reach 𝗨𝗦$𝟯.𝟰 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 in 2028, with Asia Pacific emerging as the largest market by accounting for over 40% of global sales. Read the full report

👀 NEWS HIGHLIGHT

ASX-listed Butn has entered into a binding Memorandum of Understanding (MOU) with Canadian crypto-backed lending platform APX Lending to form a Joint Venture enabling under-serviced crypto-backed lending across Australia, New Zealand and APAC.

The partnership combines Butn’s lending expertise and local market experience with APX Lending’s advanced crypto-backed lending technology to create a robust and secure platform, offering borrowers access to secured crypto-backed lending in the region.

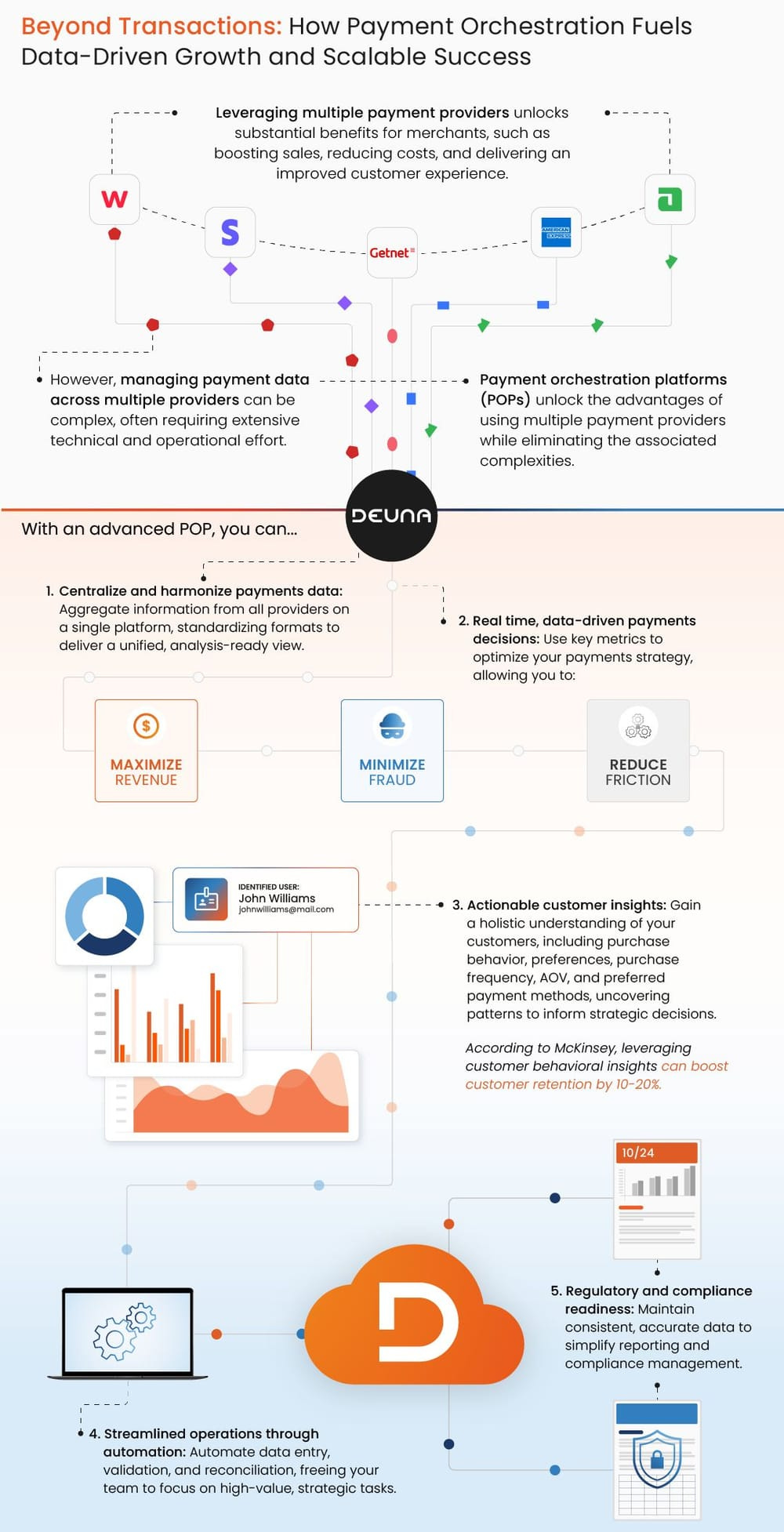

💡INSIGHTS

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🧋 REGIONAL HIGHLIGHTS

⭐️ Indian Digital Banking Ecosystem by The Digital Fifth.

⭐️ Deutsche Bank launches merchant solutions in Asia Pacific, empowering eCommerce growth.

⭐️ Fonepay Introduces Nepal’s First Virtual Credit Card With Support Of Compass Plus Technologies.

⭐️ HTX launches flexible Crypto Loans and offers a prize pool of 2.7 billion in tokens.

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

AUSTRALIA 🇦🇺

Zip Co's pioneering FinTech leader Larry Diamond to step down. Co-Founder Larry Diamond has agreed with the Board that he will step down as a director of Zip and as US Chairman to establish a Family Office and Foundation for his philanthropic endeavours.

SINGAPORE 🇸🇬

DBS and the IMDA partner to launch the Spark GenAI programme, designed to raise awareness and encourage the adoption of generative artificial intelligence (gen AI) solutions amongst Singapore’s small and medium-sized enterprises (SMEs). Read more

dtcpay announces shift to stablecoin-only payment services by 2025. This move will see the phasing out of support for Bitcoin (BTC) and Ethereum (ETH) by the end of the year, while maintaining support for all other stablecoin and fiat currency services.

Robinhood to launch in Asia in 2025 with Singapore HQ. Robinhood’s move into Asia aligns with the international expansions of competitors like Tiger Brokers and Futu Holdings, which are shifting focus from their home market after regulatory crackdowns. That could intensify competition in the industry, which is already struggling with rising costs.

Singapore to launch two new e-Payment solutions in Mid-2025 to phase out cheques. The Electronic Deferred Payment (EDP) and EDP+ solutions will offer businesses and individuals more convenient ways to make payments while phasing out the use of cheques.

Revolut applies for New Zealand Banking license and launches eSIM in Singapore Revolut has applied to the Reserve Bank of New Zealand for a banking license, as it aims to challenge banks' savings and lending products. Additionally, the company has launched eSIMs in Singapore, allowing customers to avoid unexpected roaming charges while traveling in the region.

HONG KONG 🇭🇰

KPay, a financial management platform for SMEs, raises $55M Series A. The funds will support product development, accelerate go-to-market efforts, enhance customer experience, expand into new Asian markets, and pursue growth through mergers and acquisitions, according to the company’s CFO.

MALAYSIA 🇲🇾

Atome partners with Valiram to expand payment solutions. Valiram partners with Atome to offer embedded financing and flexible payments at over 200 stores in Malaysia, including brands like Victoria’s Secret and Michael Kors. The solution will expand to 40 stores in Singapore soon.

PHILIPPINES 🇵🇭

Filipino FinTech Starpay partners with OceanBase. This partnership aims to upgrade the Relational Database Services (RDS) within Starpay's technical stack, improving its system performance and operational efficiency. Continue reading

JAPAN 🇯🇵

Japan’s SBI Holdings Inc. is set to become the majority owner of FinTech Solaris SE after making the largest contribution in the German FinTech's ongoing fundraising, according to a source. Solaris aims to raise €100–€150 million to secure funding until it expects to reach profitability in about two years, the person said.

Paytm’s Singapore arm will sell its stake — in the form of Stock Acquisition Rights (SARs) — in Japan’s PayPay for around USD 280m. Through this deal, PayPay is valued at JPY 1.06 trillion (USD 7bn) and accordingly, PayPay SARs held by Paytm Singapore are valued at net proceeds of JPY 41.9 billion (after netting off the exercise cost of SARs).