Hello FinTech Community!

Welcome back and lovely meeting you! I look forward to the insights and connections we’ll get by interacting here

👉What happened?

It funds up to 20% of the home deposit, which can then be used use to access an 80% loan-to-value ratio loan from specific lending partners.

The model ensures that a customer’s debt-to-income ratio is lower with a Deposit Boost supported home loan than going direct with an 80% LVR lender.

All Deposit Boost Loan customers are also assigned a personal Buyer’s Agent to help them find the right property at the right price.

Co-Founder James Bowe said it is time to rethink the outdated rule that only people with a 20% deposit can service a mortgage and get on the property ladder.

“It’s a myth that you can’t afford a mortgage if you don’t have a deposit,” Bowe said. “Many Australians can afford a mortgage and are wonderful prospects for bank loans, but saving 20% of an ever-growing house price keeps the dream of ownership out of reach.”

🤔 Why is this relevant?

This solution reduces one of the biggest barriers to entry for many aspiring homebuyers. It is also done allegedly with a very rigorous credit risk assessment.

Seems like Australia is a pioneer with this model, so looking forward to see the findings so that we can bring it to other parts of the world.

👉 Read the full australianfintech.com.au article here.

Also, keep in mind the following:

⭐️ Tonik renews Finastra partnership as it surpasses 1 million users

⭐️ Grab shuts down investment business in Singapore

Exciting times,

Monica

Onwards to the news!

REPORT

The report is categorized into three chapters:

The first chapter is rich with data on trends in revenue and capital flows for Fintechs across the three dimensions of region, segment and time period.

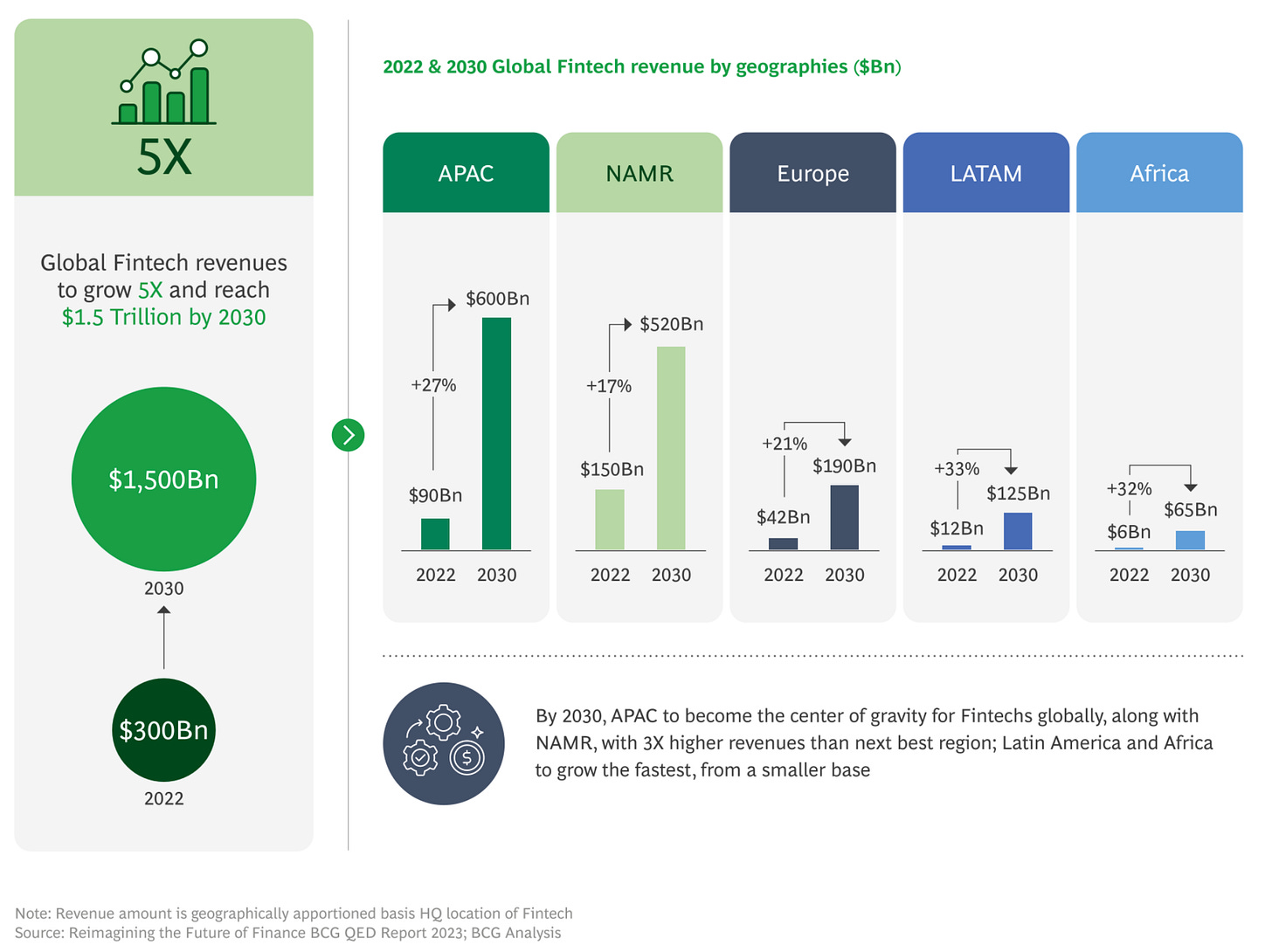

Global Fintech revenues will reach $1.5 Trillion by 2030, with APAC and NAMR emerging as major hubs.

Monetary experts have referred to central bank digital currencies (CBDCs) as “the future of payments” or even “the future of money,” and not without reason. China’s launch of its digital yuan begins a new era in payments, making China the first major economy to deploy its own CBDC.

Download the complete report here

👀 NEWS HIGHLIGHT

Coinbase Singapore is pleased to announce that we have obtained a Major Payment Institution (MPI) licence from the Monetary Authority of Singapore.

📰 ARTICLE

As the ebb and flow of FinTech funding in India paint a dynamic canvas, a close examination of the trends and their underlying currents becomes paramount to comprehend the evolving narrative.

💡INSIGHTS

Alternative payments account for nearly 60% of e-commerce market in India, reveals GlobalData.

Alternative payment methods such as mobile and digital wallets increasingly dominate the e-commerce space in India and are the most popular online payment method with 58.1% market share in 2023, according to GlobalData, publishers of EPI.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🧋 REGIONAL HIGHLIGHTS

⭐️ Thunes broadens its payment network across five southeast asian nations.

⭐️ Funding Societies secures US$27 million debt financing.

⭐️ TikTok is testing a new in-app wallet.

⭐️ Nokia 2660 gets UPI Scan & Pay Feature.

AUSTRALIA

OwnHome, a start-up funded by the Commonwealth Bank has quietly begun loaning customers their home deposits, allowing more Australians the chance to get on the property ladder.

SINGAPORE

Grab announced that it will be shuttering its investment business in Singapore by discontinuing its AutoInvest and Earn+ products.

CHINA

Alipay+ has launched its #MoneyCannotBuy marketing initiative, a series of social media campaigns and special rewards.

Nuvei Corporation announces it has opened its latest operational hub in China as it continues to expand its presence in the Asia-Pacific (APAC) region.

NEW ZEALAND

Sharesies has partnered with Māori fintech startup from New Zealand BlinkPay to introduce transformative changes in financial management for investors.

INDIA

Fi has laid off 10% of its workforce or 30 employees citing strategic restructuring. With this, it has become the second neobank after Open to conduct layoffs this year.

PHILIPPINES

Mynt is acquiring payments firm Electronic Commerce Payments Inc (ECPay) for about $40 million.

JAPAN

Laser Digital is pleased to announce the appointment of Hideaki Kudo as a Representative Director and head of Laser’s new office in Tokyo.

If you are a fintech startup and have over 100 questions, send me an email. Maybe I can answer a few.