Hello FinTech Community!

Welcome back and lovely meeting you! I look forward to all the valuable conversations we’ll have through this channel.

📣 Weekly Takeaway:

Malaysia’s 2023 Budget and it's impact to FinTechs

👉 What are the 7 key points in the Budget?

The overarching theme is ‘Developing Malaysia Madani’. Madani encompasses six guiding principles: sustainability, prosperity, innovation, respect, trust, and compassion.

The government will allocate MYR 388.1 billion across 12 areas to aid recovery post Covid.

RM1.2 billion will be allocated to speed up digitalisation among MSMEs.

RM40 million will be allocated to the Malaysia Co-Investment Fund (MYCIF) to enhance the liquidity of equity crowdfunding and peer-to-peer (P2P) markets.

RM10 million will be allocated to combat rising fraud. In 2022, RM850M were lost to fraud.

RM3 billion will be allocated to the Green Technology Financing Scheme (GTFS). Tax incentives for green investments will be introduced.

The Consumer Credit Act and Consumer Credit Oversight Board will monitor BNPL products closely.

🤔 Why this is important

We’ll start seeing a shift in the competitive landscape. The race for SME customers and green initiatives is getting started.

Expect changes in BNPL. More regulation may mean changes to your roadmap or how you market credit products. This in turn may impact unit economics and portfolio profitability.

Fraud, fraud, fraud. This is one of the largest challenges in the industry. If we get it right, both FinTechs and consumers will win. I hope we see further developments.

Overall, expect changes and a positive impact.

👉 Read the full fintechnews.my article here.

Also, keep in mind the following:

⭐️ AWS will invest US$6 billion in Malaysia by 2037.

⭐️ Singapore hits a record number of FinTech deals in 2022 with 232 deals in total.

⭐️ Today is International Women’s Day. Reflect on how to improve your business by being aware of your unconscious bias. This is a good exercise both as a man and a woman.

Monica

Onwards to the news!

REPORT

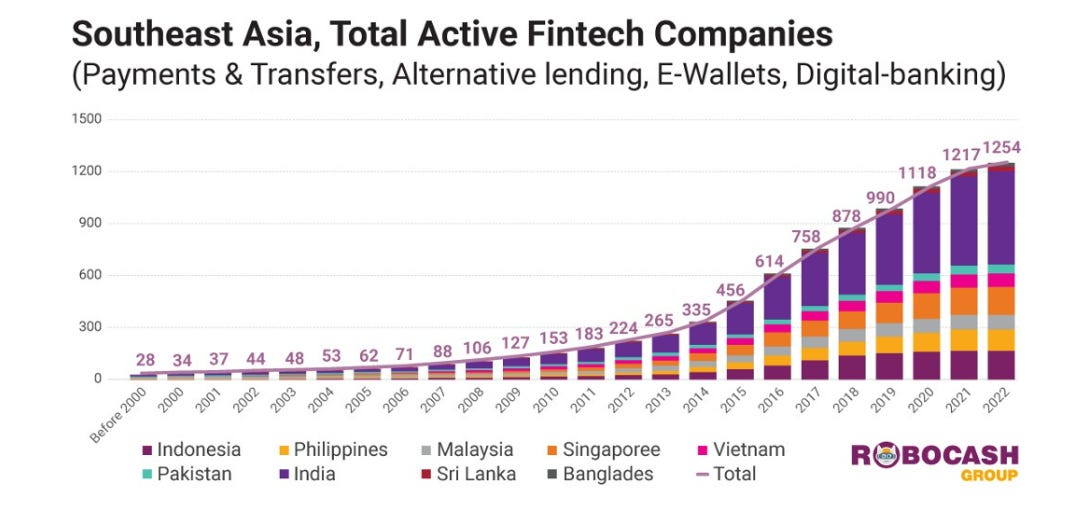

Robocash Group‘s ‘State of SEA Fintech 2022 Report‘ reveals that between 2000 and 2022, the total number of fintechs in Southeast Asia rose from 34 to 1254.

The largest increase occurred between 2015 and 2020. This period saw the launch of around 62 per cent of all existing companies from the four sectors under consideration.

📰 ARTICLE

The fintech industry in India is experiencing rapid growth due to various factors. One of the primary drivers is the increasing penetration of the internet and smartphones, enabling access to digital financial services.

According to McKinsey & Company’s report, India’s digital payments industry could reach US$1 trillion by this year.

💡INSIGHTS

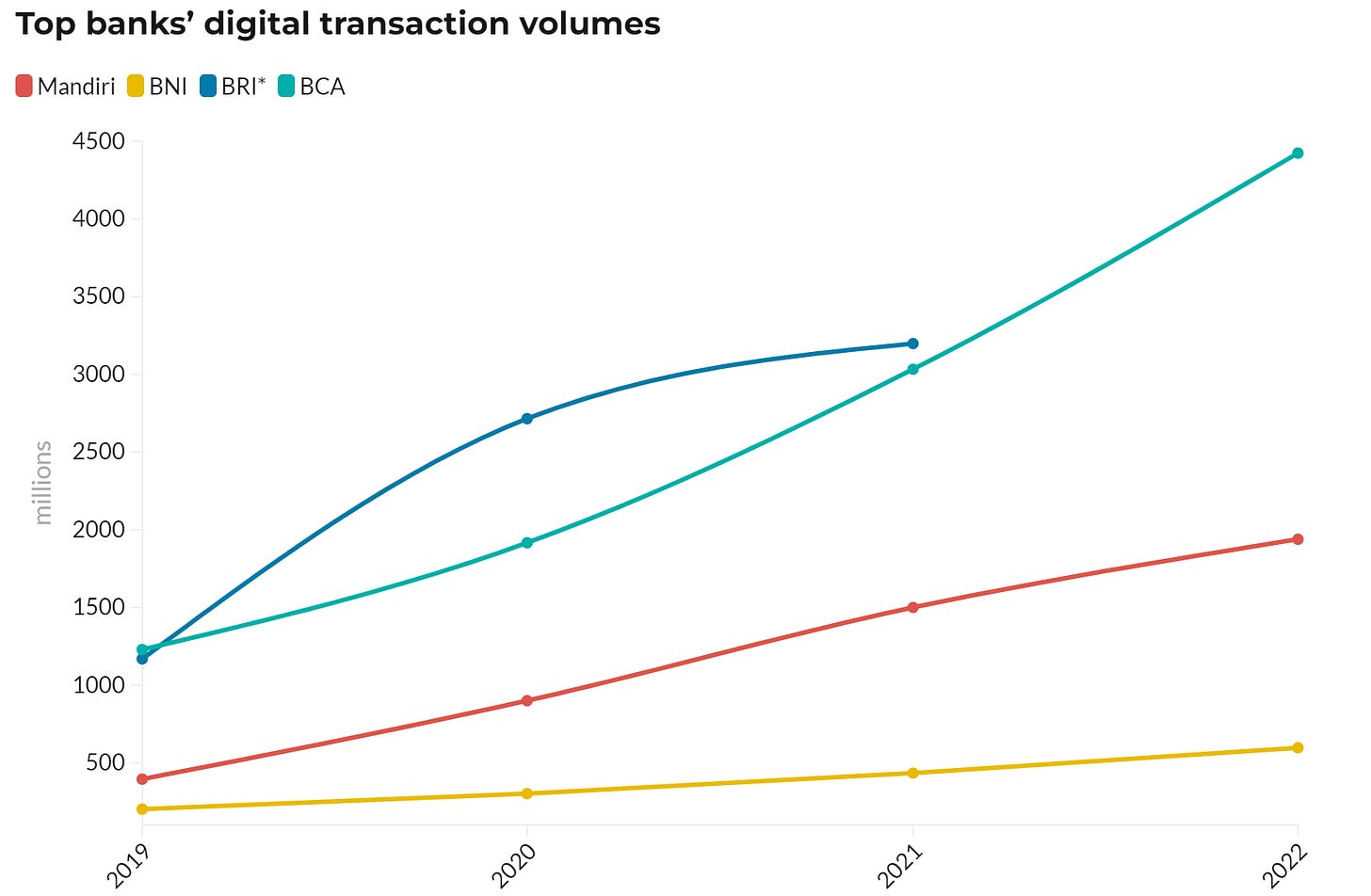

Bank Central Asia was the top bank by digital volume, and recorded the largest annual growth of 46% from 2021 to 2022.

It is the only one of the four biggest banks in Indonesia which is not state-owned, and also has the smallest number of branch offices.

🧐 ANALYSIS

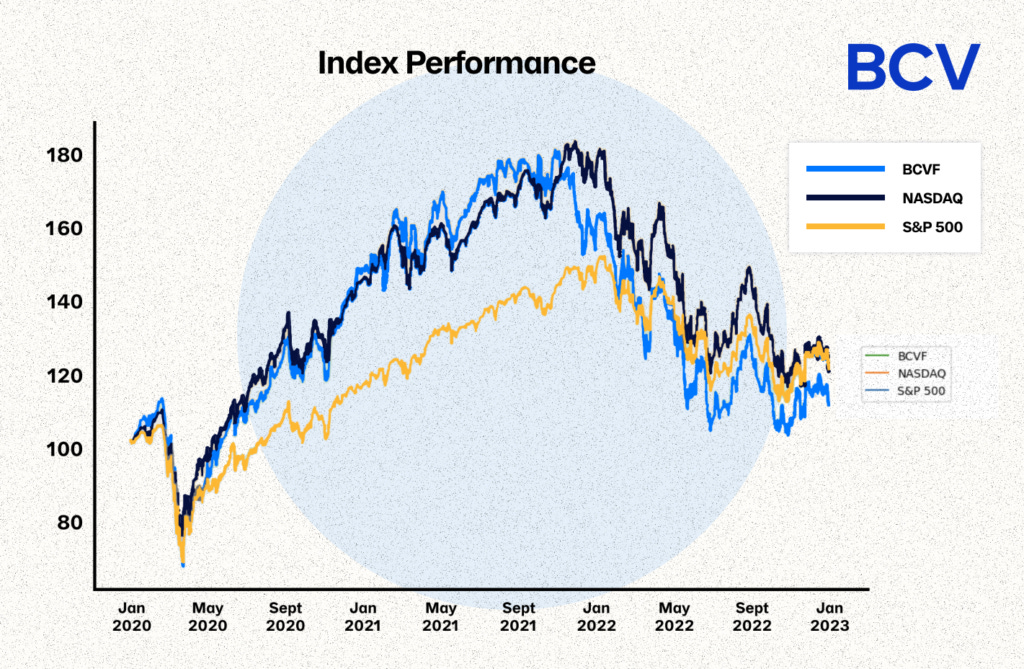

While the story of public market FinTech over the last three years has been perplexing, a retrospective analysis reveals a few simple lessons.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🧋 REGIONAL HIGHLIGHTS

⭐️ Visa and Mastercard are slamming the brakes on plans to forge new partnerships with crypto firms.

⭐️ Airwallex secured a payment business license in China, and the acquisition of a 100% stake in Guangzhou Shang Wu Tong Network.

⭐️ Pay&Go kiosks are now available at Lawson Branches for secure, convenient payments.

⭐️ GLN International secured a total strategic investment of around $83.7m from four institutions.

AUSTRALIA

Shift announced the appointment of Ross Horsburgh to the newly created role of Treasurer.

Cape launched its analytics product layer ‘Fractal’ – a real-time reporting and insights dashboard based on industry benchmarks, open banking data, and corporate card spend.

Meezan Wealth Management partners with OpenInvest to launch unique Islamic Investment Platform.

The Reserve Bank of Australia will be launching its live central bank digital currency pilot in the next few months.

Alex.Bank saw an increase in personal loan origination, by over 50% since the start of 2023.

Zip is reportedly kicking its global expansion plans into reverse, either by selling up or winding down operations in 10 of the 14 global markets it operates in.

SINGAPORE

Alchemy Pay and Berkah Digital have jointly obtained Indonesian licenses to operate remittances and fund transfers.

DigiFT closed a US$ 10.5 million Pre-Series A funding round led by Shanda Group, the global privately-owned investment group.

Blockchain Founders Fund announced the final close of its US$ 75 million Fund II to invest in pre-seed and seed stage Web3 and blockchain startups.

Singapore stablecoins to gain market share as a “last-mile” settlement product.

Singapore's fintech sector enjoyed a mixed year in 2022, with a record level of activity but a significant drop in the level of funding, according to recently published data.

HONG KONG

HSBC granted its first green loan to a climate-mitigation technology firm, fighting global warming by financing clients’ emissions reduction projects.

AsiaPay launched Visa Instalments in Hong Kong and will further extend to Southeast Asia to provide merchants with more flexible payment options and enhance the purchase experience of consumers.

JAPAN

G-Bank Technologies OÜ and GIG-A launched their multilingual mobile financial service offering in Japan, allowing users to easily and inexpensively open bank accounts.

VIETNAM

F88 secured at least US$50 million, mainly from two investment funds, ahead of a potential domestic IPO next year.

UOB finalised the acquisition of Citigroup’s consumer banking business which comprises its lending portfolios, wealth management and retail deposit businesses.

INDIA

Explorex partnered with MSwipe, to streamline payment solutions to their partner restaurants.

INDONESIA

The potential merger of Bank Nobu and Bank MNC will combine the ecosystem of two of Indonesia’s top corporate groups.

Fazz confirmed that it had conducted a round of layoffs on March 1. from all offices in the region.

Broom secured $8 million in a Series A funding round led by Openspace Ventures.

PHILIPPINES

BillEase partnered with iPay88 to provide merchants with flexible payment options for their customers.

Brankas introduced a multi-bank API that reportedly is the first of its kind in the Asia Pacific region, with an initial launch in Indonesia and the Philippines.

PAKISTAN

Trukkr raised $6.4 million in a funding round and also received a non-bank financial company (NBFC) license.

If you are a fintech startup and have over 100 questions, send me an email. Maybe I can answer a few.